You might be asking yourself how this will work Along with the prepayment penalty coverage check. It’s very simple: the thresholds while in the prepayment penalty protection test are The brand new most limit. If a lender makes a loan letting for your prepayment penalty extending beyond the 36-thirty day period limit, or for an volume bigger than two% of your pay as you go amount, that loan is a Section 32 loan.

At times, we could supply links to web sites outside the house the Charge of our credit history union. We don't make any representations regarding the linked websites’ contents or availability.

A repayment routine that consolidates more than two periodic payments which have been to become paid out upfront from your proceeds of the loan.

Creditors are also prohibited from partaking within a pattern or practice of lending determined by the collateral price of your home with no regard to your power to repay the loan.

With a single, easy variety, it is possible to obtain a network of lenders presenting a lot more selections to fulfill your preferences. Finish the shape in minutes within the comfort and ease of your own home, and if accredited, get pleasure from following-day direct deposit proper into your account.

the annual share rate (APR) exceeds by greater than ten share details the charges on Treasury securities of comparable maturity; or

In observe currently, Segment 32 loans are several and far between. Limits on Part 32 loan conditions, the additional disclosures needed and heavy penalties for violations make these loans unattractive to traders.

? Our A.I. Algorithm has calculated your odds to receive a offer right now in a Outstanding ... 0% You should supply the final four digits of your respective SSN: There's a very good opportunity We now have your file within just our lending network.

As much as two bona fide lower price details could be excluded In case the interest fee ahead of the price reduction is 1 share stage or fewer under the APOR.

the speed in impact on the date the desire rate is ready (if the fee is locked, or at loan closing) for a set-rate loan;

the quantity of the periodic payments and any closing/balloon payment, if balloon payments are permitted, with a closed-close loan;

This is particularly critical for originators of increased-danger, B- or C-paper home loans or for brokers who function with personal investors. Because these mortgages have an increased chance, they normally come with a better charge and expenditures to buyers.

The regular Reg Z disclosures ought to always be produced on a personal-use loan, whether it had been also categorised as a piece 32 loan.

How this performs WHO IS DISPLAYED? The MRC network lenders (all of whom may very well be noticed listed here) who seem are exhibited according website to information and facts you furnished, availability of our community lenders, as well as their geographic proximity to you. MRC displays any Neighborhood Lenders obtainable in its network first; an area Lender is really a lender who products and services 1-2 states, including the condition you happen to be seeking in. If no Community Lenders are offered, a Regional Lender is going to be shown; a Regional Lender is really a lender who operates inside the house condition you chose and up to twenty-5 bordering states.

Andrea Barber Then & Now!

Andrea Barber Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Shannon Elizabeth Then & Now!

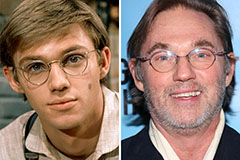

Shannon Elizabeth Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!